AiPrise

7 min read

March 19, 2025

St. Vincent And The Grenadines Companies Verification Guide

Key Takeaways

St. Vincent and the Grenadines, known for its growing financial sector and attractive business environment, offers significant opportunities for companies operating in the region. However, with these opportunities comes the responsibility of adhering to compliance standards. Conducting Know Your Business (KYB) checks ensures you engage with legitimate business partners while complying with local regulations.

This blog outlines the KYB process in St. Vincent and the Grenadines, including its legal framework, required documentation, and best practices for seamless compliance.

Understanding KYB in St. Vincent and the Grenadines

Know Your Business (KYB) refers to the procedures that financial institutions and other businesses implement to verify the identity and legitimacy of their corporate clients. This process is particularly important in preventing fraud, money laundering, and other illicit activities that could harm businesses and the economy.

In St. Vincent and the Grenadines, KYB is not just a regulatory requirement but fosters trust between businesses and their clients. By ensuring that companies engage with legitimate entities, businesses can protect themselves from potential fraud or financial crime risks.

With a clear understanding of KYB, let's move on to the legal framework that governs these processes in St. Vincent and the Grenadines.

Legal Framework Governing KYB in St. Vincent and the Grenadines

The KYB process in St. Vincent and the Grenadines is guided by a robust legal framework designed to ensure financial integrity and transparency.

- Anti-Money Laundering and Counter-Terrorism Financing (AML/CFT) Regulations: Mandates due diligence and reporting to prevent financial crimes.

- Financial Services Authority Act: Governs the operations of financial institutions and enforces compliance standards.

- International Business Companies Act: Regulates the formation and compliance of offshore entities operating within the jurisdiction.

- The Proceeds of Crime Act: Outlines measures to prevent money laundering and requires businesses to conduct due diligence on their clients.

- The Anti-Money Laundering Regulations: These regulations provide specific business guidelines regarding customer verification processes.

- The Financial Intelligence Unit (FIU): The FIU oversees compliance with anti-money laundering laws and ensures businesses adhere to KYB requirements.

Understanding these laws is crucial for businesses as they establish a baseline for compliance efforts. Now that we have covered the legal aspects, let’s discuss how to effectively implement KYB in your business operations.

To ensure compliance with these requirements, consider partnering with AiPrise. Our tailored compliance solutions simplify the process, allowing you to focus on your core business while we manage the complexities of regulatory adherence.

Steps to Implement KYB in St. Vincent and the Grenadines

To conduct KYB effectively in St. Vincent and the Grenadines, follow these structured steps:

- Collect Documentation: Gather necessary records such as business registration certificates and ownership details.

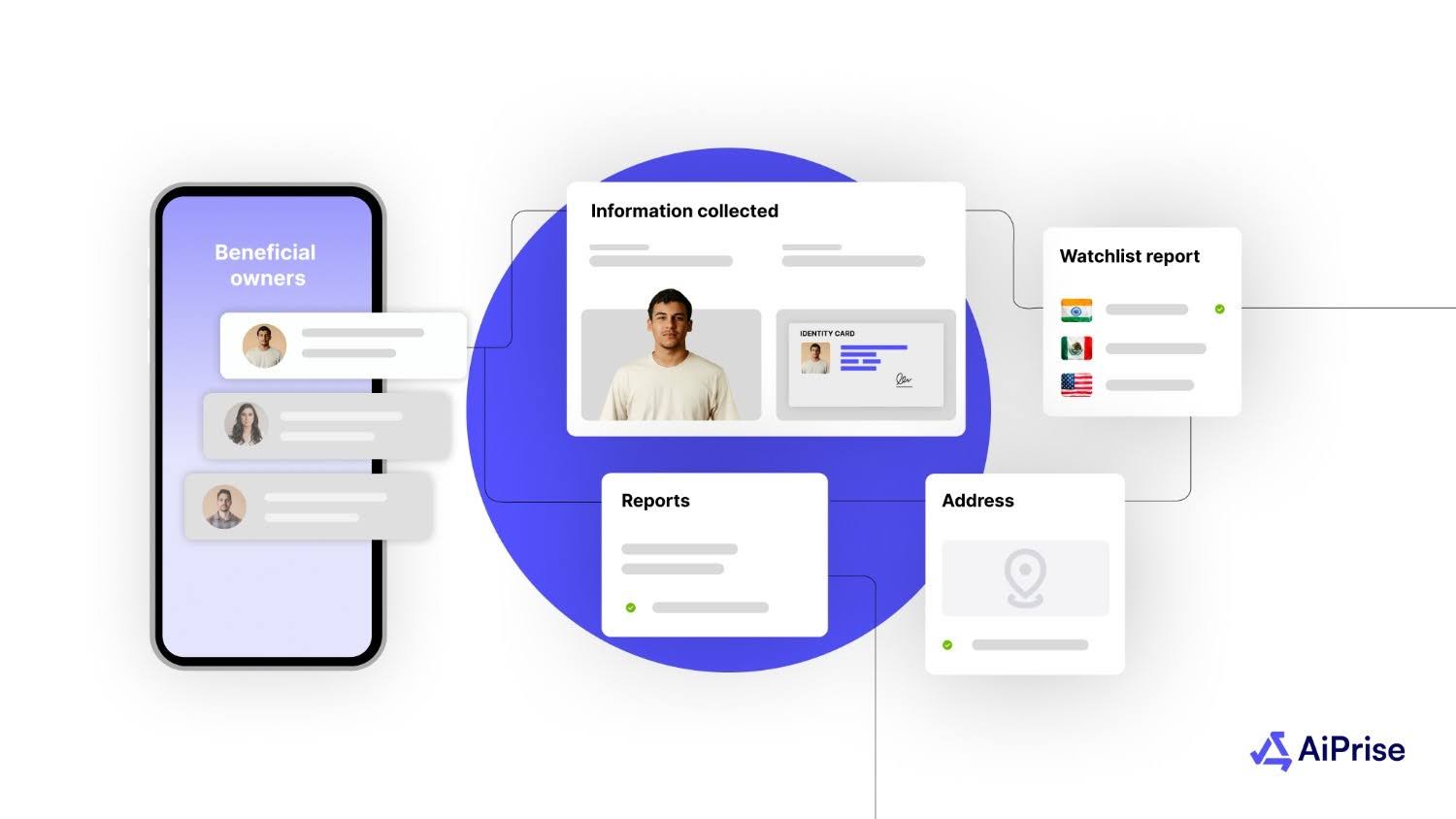

- Verify Ownership Structures: Identify and validate Ultimate Beneficial Owners (UBOs) to ensure transparency.

- Assess Compliance: Cross-check entities against AML and CFT compliance databases to identify potential risks.

- Conduct Risk Analysis: Evaluate the financial health and operational stability of the entity.

- Monitor and Update Records: Continuously monitor compliance and update KYB records as needed.

You can create a solid foundation for your KYB processes by following these steps diligently. Now that you know how to implement KYB effectively, let’s look at the documentation required for compliance.

Required Documentation for KYB Compliance

The documentation required for KYB in St. Vincent and the Grenadines includes:

- Business Registration Documents: Certificates of Incorporation or similar proof of business registration.

- Ownership and UBO Information: Shareholder agreements and declarations identifying UBOs.

- Tax Compliance Records: Taxpayer Identification Numbers (TINs) and proof of recent tax filings.

- Financial Records: Audited financial statements or bank references.

- Identification Documents: National IDs or passports of directors and UBOs.

Having these documents readily available will streamline your compliance efforts. With documentation in place, let’s explore some challenges you may face during the KYB process.

Suggested read: How to do KYB in Romania?

Challenges for KYB in St. Vincent and the Grenadines

While implementing KYB processes is vital, several challenges can arise:

- Lack of Standardization: Different industries may have varying standards for documentation and verification processes, leading to inconsistencies.

- Resource Constraints: Smaller businesses may struggle to allocate sufficient resources for comprehensive KYB checks due to budget limitations.

- Evolving Regulations: Keeping up with changing laws and regulations can be daunting for businesses trying to maintain compliance.

- Complex Ownership Structures: Identifying UBOs in multinational entities can be resource-intensive.

- Limited Digital Infrastructure: Manual processes and lack of digital records can slow verification efforts.

Addressing these challenges proactively will enhance your ability to execute effective KYB processes. Now that we've identified some obstacles, let’s discuss the best practices you can adopt for successful implementation.

Best Practices for KYB in St. Vincent and the Grenadines

To optimize your KYB processes, consider adopting these best practices:

- Implement a Risk-Based Approach: Tailor your verification efforts based on each client's risk profile rather than applying a one-size-fits-all approach.

- Utilize Technology Solutions: Leverage digital tools and platforms that automate parts of the verification process to enhance efficiency and accuracy.

- Conduct Regular Training: Ensure your staff is well-trained in compliance requirements and best practices related to KYB procedures.

- Engage Third-Party Providers: Collaborate with specialized firms that offer expertise in compliance solutions to strengthen your verification processes.

- Maintain Up-to-Date Records: Regularly review and update KYB data to reflect organizational changes.

- Implement Real-Time Monitoring: Leverage tools that provide alerts for changes in compliance status or ownership structures.

Integrating these best practices into your operations can significantly improve your KYB effectiveness. Transitioning from best practices, let’s examine how technology enhances these processes in St. Vincent and the Grenadines.

For effective KYB practices, partnering with specialized firms like AiPrise can enhance compliance efforts. Our robust solutions are tailored to the needs of businesses in St. Vincent and the Grenadines, helping you strengthen your KYB processes and ensure regulatory adherence.

Technology and KYB Processes in St. Vincent and the Grenadines

Technology has become invaluable in streamlining KYB processes:

- Automated Verification Systems: These systems can quickly verify business identities against public databases, reducing manual workload and errors.

- Data Analytics Tools: Utilizing analytics can help identify patterns or anomalies that may indicate fraudulent activities during client assessments.

- Secure Document Management Solutions: Implementing secure systems for storing sensitive documents ensures compliance while protecting client information from breaches.

Using technology enhances efficiency and fosters greater accuracy in your verification efforts. As we conclude this discussion on technology's role in KYB processes, let's summarize our insights with a closing thought.

Conclusion

St. Vincent and the Grenadines presents a unique business environment where compliance and trust are paramount. Conducting KYB here is not just about meeting regulatory obligations but safeguarding your business and establishing long-lasting partnerships built on transparency.

By proactively addressing challenges like limited digital infrastructure and complex ownership structures, you can turn KYB into a competitive advantage. AiPrise provides innovative KYB solutions tailored to the complexities of St. Vincent and the Grenadines.

You can now streamline your compliance process and focus on what truly matters—growing your business. Explore how AiPrise can empower your KYB efforts at AiPrise.

You might want to read these...

Aiprise has helped streamline our KYB (Know Your Business) flow in 100+ countries. No other tool comes close.

Speed Up Your Compliance by 10x

Automate your compliance processes with AiPrise and focus on growing your business.

%20Can%20Improve%20Your%20Compliance%20Strategy.png)