AiPrise

8 min read

April 24, 2025

How Compliance Technology Drives Efficiency and Trends

Key Takeaways

In any business, the cost of non-compliance is far higher than the cost of staying compliant. In fact, the average cost of non-compliance is approximately 2.7 times greater than the cost of compliance itself. That’s a significant gap, and it's one that businesses can no longer afford to ignore. As the regulatory environment becomes more complex, particularly in industries like finance, payments, and cryptocurrency, companies must rethink how they approach compliance.

Regulations are evolving rapidly, and businesses must adapt to new standards to avoid hefty fines, reputational damage, and operational inefficiencies. Compliance doesn’t exist in a vacuum; it’s a response to shifts in the financial system and the increasing uncertainty in global markets. It's crucial for businesses to stay on top of these changes if they want to stay competitive and avoid expensive penalties.

Fortunately, recent advances in compliance technology provide practical solutions that make it simpler to meet regulatory standards and lower associated costs. In this blog, we'll look at how compliance technology is not only helping businesses stay compliant but also improving efficiency across different industries.

AI and Compliance: An Effective Tool

Artificial Intelligence (AI) has quickly become a key part of today’s compliance strategies. With the growing complexity of regulatory requirements, companies are increasingly relying on AI to automate and optimize their compliance processes. By using AI-powered tools, businesses can not only ensure regulatory adherence but also improve their operational efficiency.

The Role of AI in Compliance

AI is reshaping the way businesses handle compliance by automating everyday tasks, spotting risks more quickly, and improving decision-making. Here are a few key ways AI is making a difference in compliance management:

- Risk Detection: AI-driven tools can analyze large volumes of data to spot emerging risks and patterns that may not be visible through traditional compliance methods.

- Automating Audits: AI and machine learning can handle many audit tasks automatically, minimizing the reliance on manual input and lowering the possibility of errors.

Benefits of AI for Compliance

AI brings numerous benefits to improving compliance operations, including:

- Continuous Monitoring: Unlike traditional methods that only check compliance at set intervals, AI provides constant monitoring of transactions and activities, ensuring compliance is maintained at all times.

- Reducing Compliance Costs: By automating manual tasks and improving risk detection, AI helps lower the overall costs associated with compliance management, enabling businesses to allocate resources more effectively.

While AI plays a central role, there are several other key technologies that complement its power and drive efficiency in compliance management.

Also Read: Defining Marketplace Risk And How To Prevent It

Key Technologies Driving Compliance Efficiency

Compliance technology has evolved significantly over the years. Today, businesses have access to a variety of tools designed to help them meet regulatory demands with minimal effort and maximum efficiency. These technologies not only ensure regulatory adherence but also simplify operations, reduce manual workloads, and lower the risk of human error.

Several key technologies are driving this transformation:

1. Regulatory Technology (RegTech)

RegTech solutions automate many of the time-consuming and repetitive compliance tasks that were once handled manually. By integrating RegTech, businesses can automate risk assessments, reporting, and regulatory filings. This results in considerable time savings and lowers the chances of mistakes that could lead to expensive compliance issues.

2. Data Analytics

Businesses are increasingly using large datasets to identify emerging risks and trends. Data analytics can help companies spot discrepancies, assess potential vulnerabilities, and predict future compliance challenges. Predictive analytics allows organizations to proactively address potential issues before they escalate, saving both time and resources.

3. Blockchain Technology

Blockchain’s role in compliance is growing rapidly. In areas like bank confirmations and auditing, blockchain provides an immutable and transparent ledger that greatly reduces the chances of financial misstatements. Studies have shown that blockchain adoption can enhance audit efficiency, leading to lower audit fees and faster reporting. Blockchain’s decentralized structure makes sure that every transaction is fully transparent, verifiable, and secure, making it an ideal technology for industries that require robust compliance, such as banking and finance.

4. Real-Time Monitoring Systems

Real-time monitoring systems allow businesses to track transactions and activities continuously, ensuring that compliance issues are identified and addressed promptly. These systems are vital for detecting and preventing fraud in real time, providing businesses with the tools they need to remain compliant while preventing financial crimes before they occur.

Each of these technologies offers significant benefits, allowing businesses to improve compliance efficiency, reduce costs, and enhance operational workflows. However, the implementation of these technologies also comes with its own set of challenges, which we will explore in the next section.

Overcoming Challenges in Compliance Technology

Adopting compliance technology comes with many advantages, but it also brings a few challenges that businesses need to address. The rapid evolution of compliance tools requires significant investment in both time and resources. Many businesses face difficulties integrating new technologies into their existing systems, particularly when legacy infrastructure is involved. Moreover, businesses must ensure that they are compliant with global standards, as regulations can vary greatly between different regions.

Here are some of the key challenges businesses face when implementing compliance technology:

- Regulatory Complexity: Compliance requirements vary greatly across different countries and industries. Staying on top of ever-changing regulations can be a daunting challenge, particularly for businesses that operate across borders. It’s important for businesses to keep up with changing regulations and invest in tools that can help them meet these diverse standards.

- Data Privacy Concerns: As businesses rely more heavily on data analytics to ensure compliance, they must also prioritize data privacy. With regulations like GDPR, businesses must ensure they handle sensitive customer data with care. Not meeting data privacy requirements can result in hefty fines and harm a company’s reputation.

- Integration with Legacy Systems: One of the major hurdles for businesses adopting new compliance technology is integrating these solutions with older legacy systems. Legacy infrastructure is often not compatible with newer technologies, which can lead to operational inefficiencies and increased costs. A thoughtful, step-by-step approach is essential to ensure the transition goes smoothly and doesn’t interfere with ongoing operations.

- Cost of Adoption: Implementing new compliance technology often comes with a significant upfront investment. However, businesses should view this as a long-term investment, as the benefits, such as reduced compliance costs, lower penalties, and enhanced operational efficiency, outweigh the initial costs.

Overcoming these challenges requires careful planning, adequate resources, and a clear understanding of how the new technology will integrate with existing processes. By addressing these issues head-on, businesses can better position themselves to maximize the benefits of compliance technology.

Also Read: Challenges And Solutions In Cross-Border Identity Verification

Simplifying Compliance with AiPrise

As businesses face increasingly complex regulatory environments, the need for advanced compliance technology has never been more critical. Solutions like AiPrise offer a comprehensive suite of tools designed to simplify the compliance process, ensuring businesses stay compliant with global regulations while enhancing efficiency.

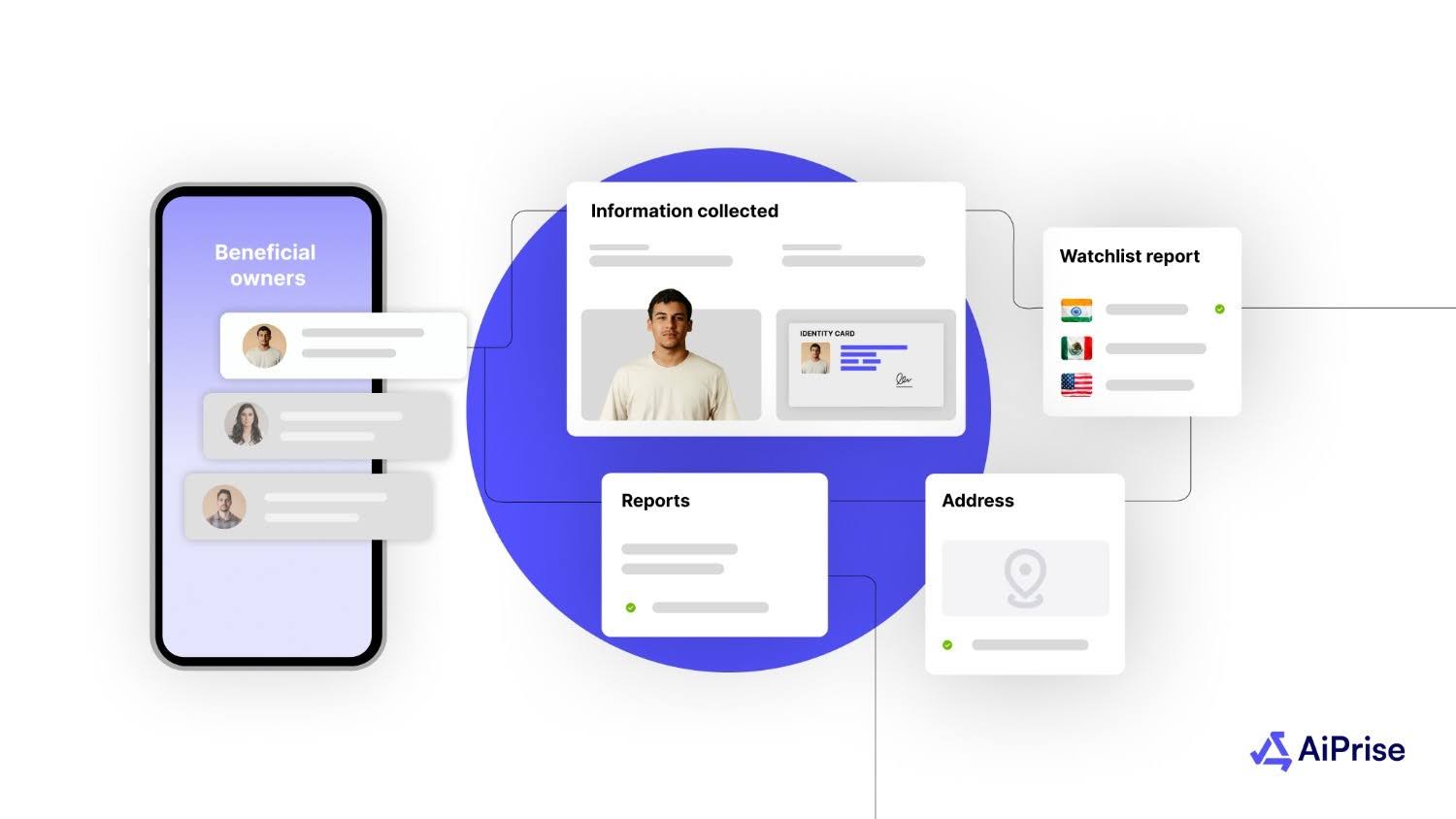

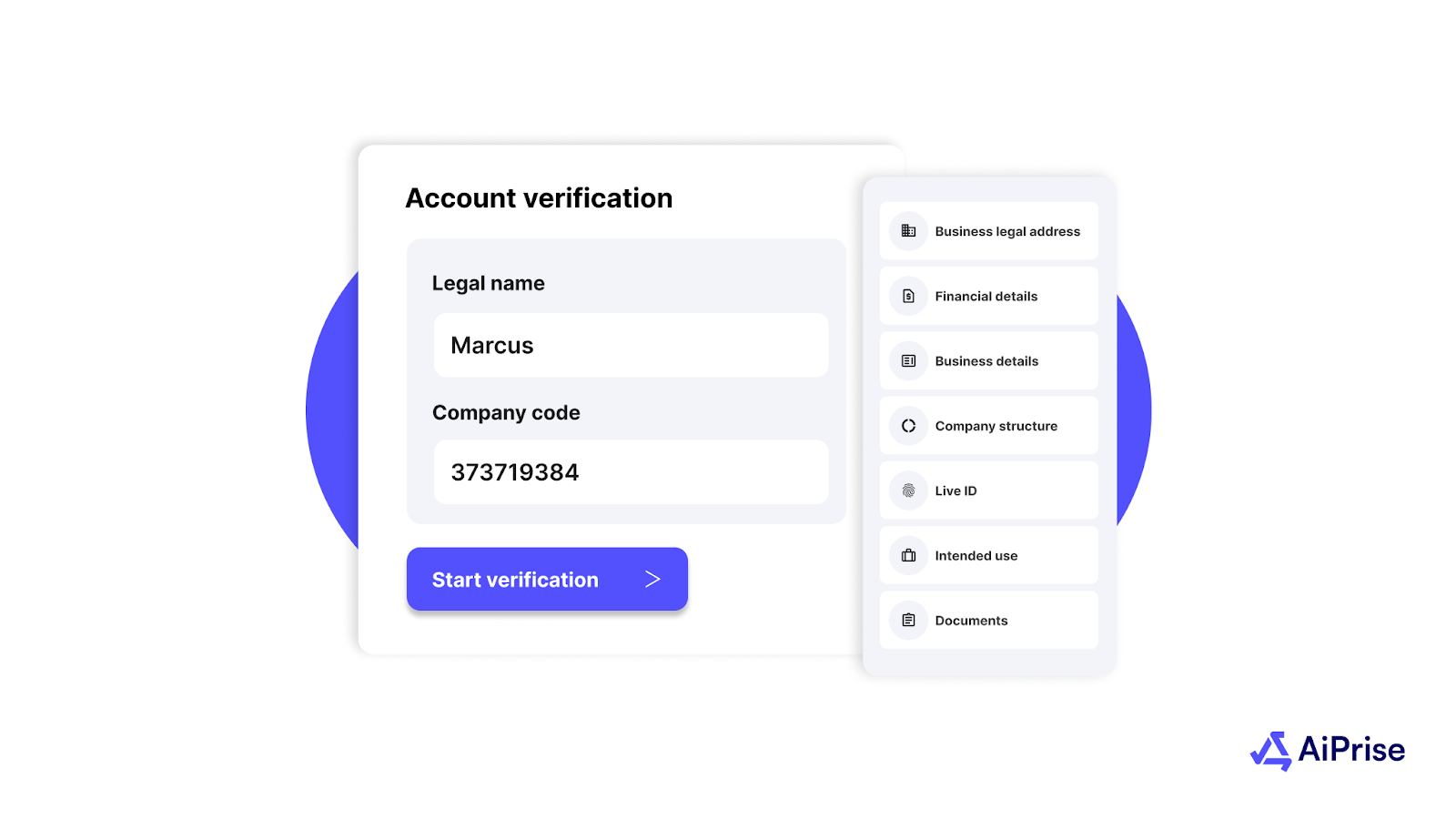

AiPrise provides robust KYC (Know Your Customer) and KYB (Know Your Business) verification tools, enabling businesses to conduct accurate identity checks and validate business details from various international sources. These tools ensure that businesses are meeting regulatory requirements while protecting themselves from potential financial crimes.

Additionally, AiPrise’s AML (Anti-Money Laundering) tools provide businesses with an all-in-one solution for identifying and stopping financial crimes before they can cause harm. AiPrise helps businesses stay in sync with changing global regulations by providing real-time monitoring and regular compliance updates, minimizing the risks linked to non-compliance.

If you’re looking to enhance your compliance processes, book a demo with AiPrise today!

You might want to read these...

Aiprise has helped streamline our KYB (Know Your Business) flow in 100+ countries. No other tool comes close.

Speed Up Your Compliance by 10x

Automate your compliance processes with AiPrise and focus on growing your business.

%20Can%20Improve%20Your%20Compliance%20Strategy.png)

.png)

.png)